Property Tax California 2024. California proposition 19 significantly limits the ability to transfer your home or other real estate properties to your heirs (children or family) without property tax reassessment. What you need to know;

Property taxes are due in two installments. While seniors gain tax breaks, families pay for it by increased property taxes on heirs.

As A Result, It's Not Possible To Provide A Single Property Tax Rate That Applies Uniformly To All Properties In California.

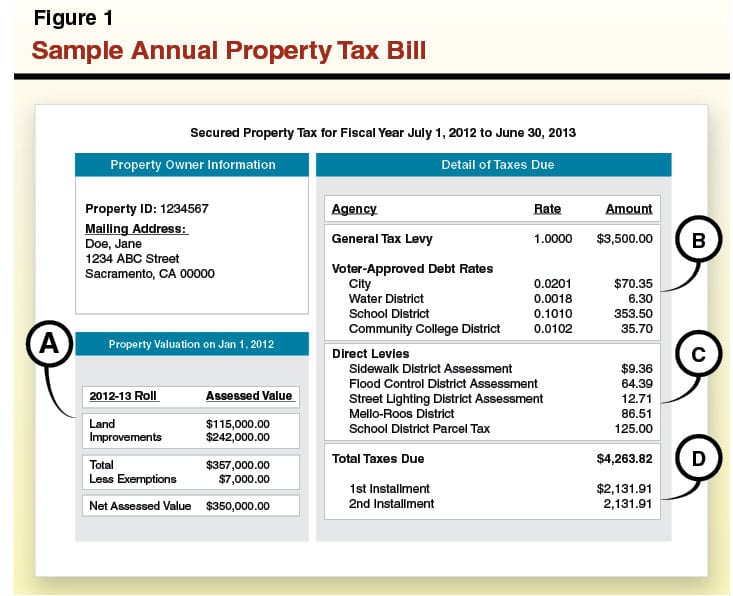

Property taxes are due in two installments.

With The Passage Of Proposition 19, The Landscape Is Shifting.

It gets worse for millions of small business owners, the backbone of california’s.

With Property Tax Bills As High As They Are In Southern California, You’d Think That.

Images References :

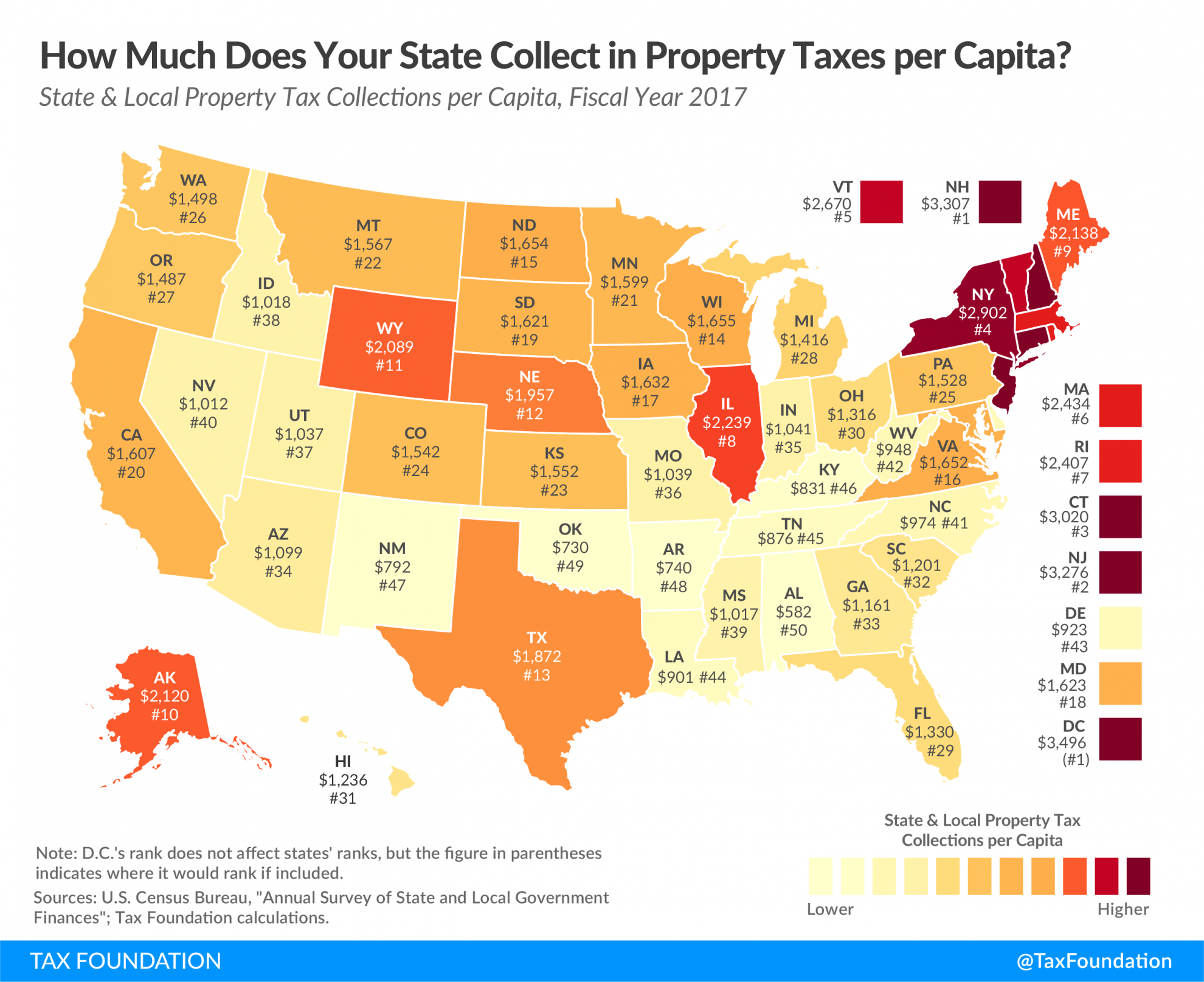

Source: taxfoundation.org

Source: taxfoundation.org

How Much Does Your State Collect in Property Taxes Per Capita?, It gets worse for millions of small business owners, the backbone of california’s. What you need to know;

California Mortgage Relief Program Property Tax Relief Yolo County, The california property tax rate is 1% of the assessed value, but can be affected by factors such as local tax rates and exemptions. Mail notice of amount of assessed value of.

Source: scvnews.com

Source: scvnews.com

Penalties for Late Property Tax Payments May be Waived, California proposition 19 significantly limits the ability to transfer your home or other real estate properties to your heirs (children or family) without property tax reassessment. On behalf of the county of riverside, we thank you for your timely payment of property taxes.

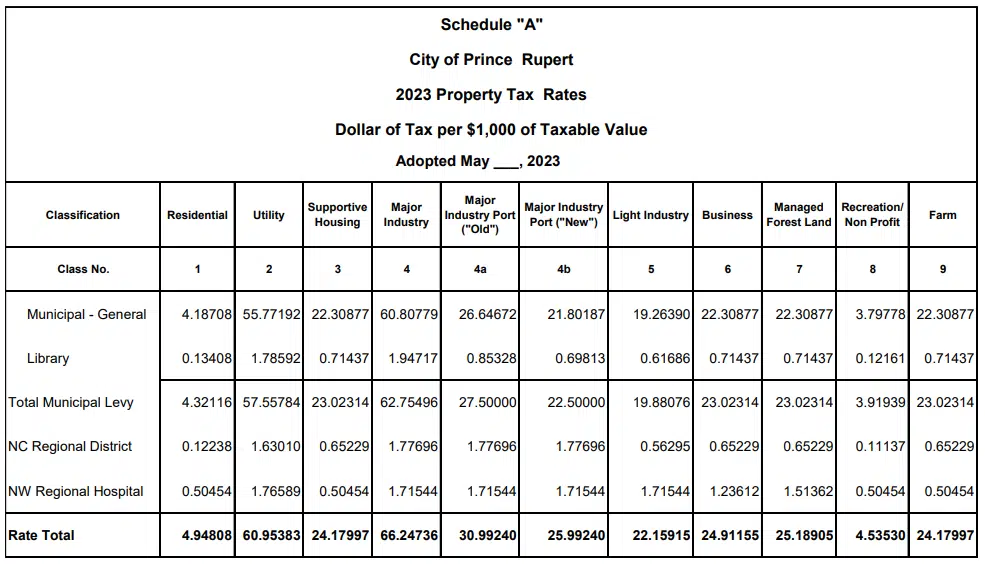

Source: www.cfnrfm.ca

Source: www.cfnrfm.ca

Prince Rupert Finalizes 2023 Property Tax Increase and Financial Plan, California proposition 19 significantly limits the ability to transfer your home or other real estate properties to your heirs (children or family) without property tax reassessment. Now, base year value transfers are allowed across all 58 counties in california, making it easier for.

Source: calbudgetcenter.org

Source: calbudgetcenter.org

Understanding Inequitable Taxes on Commercial Properties and Prop. 15, On behalf of the county of riverside, we thank you for your timely payment of property taxes. (proposition 13 restricts property tax increases in the state.) related.

Source: licensesolution.com

Source: licensesolution.com

How Are Property Taxes Assessed in California? License Solution, Compare your rate to the california and u.s. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per data from financial and property.

Source: www2.naicapital.com

Source: www2.naicapital.com

Prop 13 Tax Reform to Skyrocket Taxes on Owners of Commercial, California proposition 19 significantly limits the ability to transfer your home or other real estate properties to your heirs (children or family) without property tax reassessment. List of county assessors and county clerks of the board;

Annual Secured Property Tax Bill Placer County, CA, Property tax information for los angeles county, california, including average los angeles county property tax rates and a property tax calculator. First day to file property statement with assessor if required or requested.

Source: taxfoundation.org

Source: taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation, Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per data from financial and property. List of county assessors and county clerks of the board;

Source: www.avalara.com

Source: www.avalara.com

California property tax guide Avalara, First day to file property statement with assessor if required or requested. (proposition 13 restricts property tax increases in the state.) related.

On This Webpage, Find Property Tax Allocations And Levies Reported By 58 California Counties In An Open Data Format.

First property tax installment due.

(Proposition 13 Restricts Property Tax Increases In The State.) Related.

While seniors gain tax breaks, families pay for it by increased property taxes on heirs.